Benefits of Business Credit: Why Your Company Should Build and Leverage It

If you’re still using your personal credit to fund your business — you’re not just putting your personal assets at risk, you’re also leaving serious money on the table. At AffluentCF, we help business owners break free from personal credit limits and build a powerful business credit profile that unlocks real capital, real leverage, and real protection.

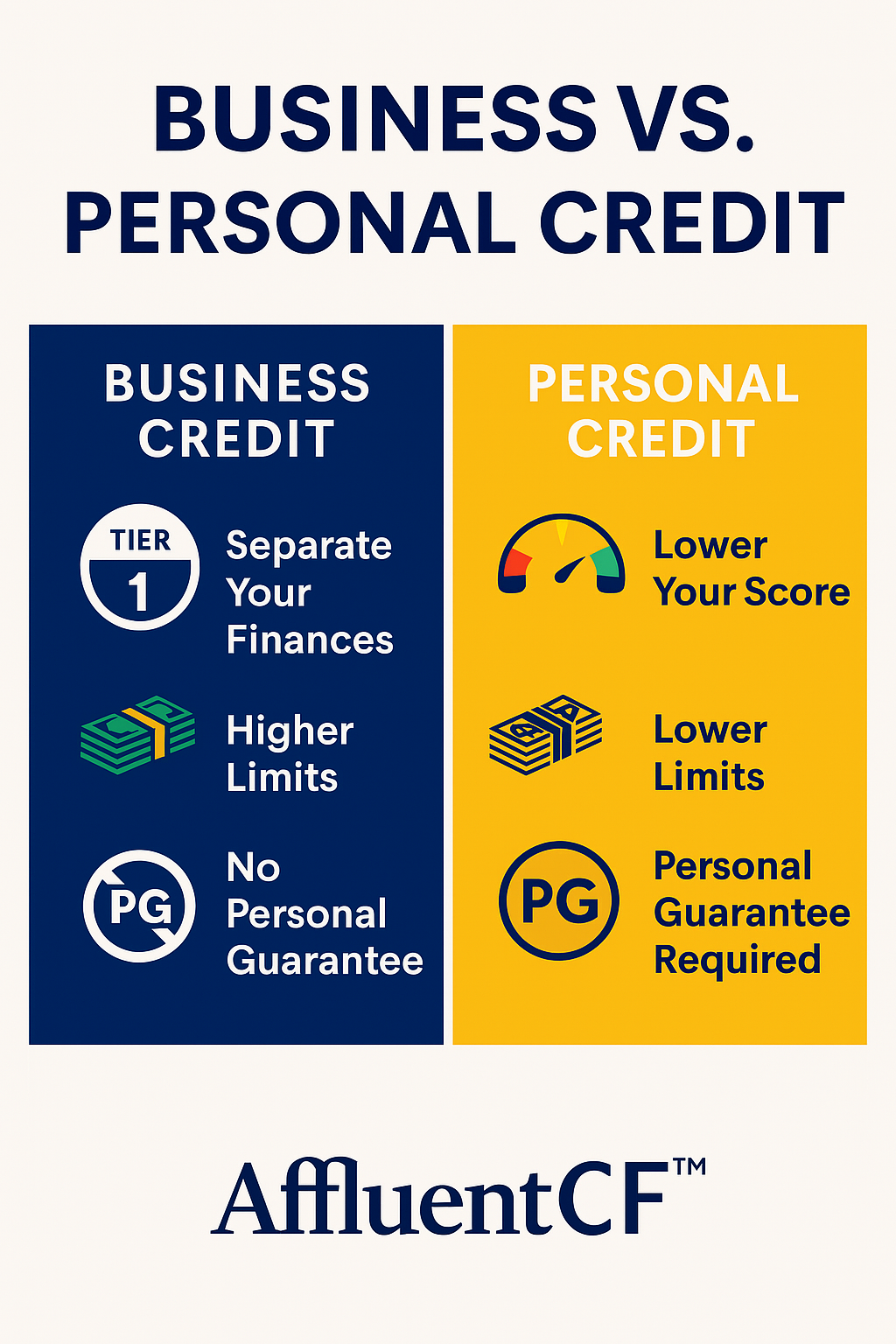

Why Business Credit Matters:

1. Protect Your Personal Credit

Business credit separates your personal finances from your company’s. That means:

- No more maxed-out cards dragging your score down

- No personal guarantees (PGs) on every loan or credit line

- Peace of mind if your business has a slow month

2. Get Higher Credit Limits

Business credit cards and lines of credit typically offer 2x–10x higher limits than personal cards. This means:

- More cash flow flexibility

- Easier equipment or inventory purchases

- The ability to scale without scrambling

3. Qualify for Business-Only Funding

With the right credit profile, you can access:

- No-PG credit cards

- Vendor tradelines

- Revolving credit lines

- SBA loans — without your personal score being the anchor

4. Become More Attractive to Banks and Investors

A solid business credit profile shows banks you’re structured, responsible, and worth investing in. That opens the door to:

- Better interest rates

- Easier loan approvals

- Valuation boosts if you ever decide to sell

💡 Did You Know?

You can have an 80+ Paydex score and multiple tradelines in under 90 days — even if your personal credit is shaky.

🚀 Ready to Build Yours?

At AffluentCF, we help you:

- Structure your business profile the right way

- Register with DUNS and Experian

- Add real tradelines fast

- Stack credit cards without personal guarantees